The Top 10 Ways Real Estate Investing Crushes Stock Market Investment in 2025

By Jared Hottle | Published: 2025-11-07T18:00:03.260Z

In an era marked by unprecedented market volatility, soaring inflation, and economic uncertainty, investors are desperately seeking stable, wealth-building opportunities. While Wall Street pundits continue to preach the gospel of stock market investing, 2025 has revealed a compelling truth: real estate investing offers superior advantages that the stock market simply cannot match.

Recent data from Gallup's 2025 investor survey confirms what savvy investors have known for over a decade—real estate ranks as the #1 long-term investment for the 12th consecutive year, with Americans viewing property as "tangible, wealth-building, and inflation-resistant" Lovette Properties. This isn't mere sentiment; it's backed by hard data and market performance that demonstrates real estate's unique ability to generate wealth while providing stability.

Let me dive deep into the 10 most compelling reasons why real estate investing outperforms stock market investment in 2025.

1. Leverage: The Ultimate Wealth Multiplier

The power of leverage represents perhaps the most significant advantage real estate holds over stocks. When you invest in real estate, you can control a $500,000 asset with as little as $100,000 down—a 5:1 leverage ratio that amplifies your returns exponentially.

Consider this stark comparison: if you invest $100,000 in stocks and the market rises 10%, you earn $10,000. But with real estate, that same $100,000 down payment on a $500,000 property that appreciates 5% generates $25,000 in equity gains—more than double the stock return with half the market movement Business Insider.

In 2025's interest rate environment, with mortgage rates stabilizing around 6.5-7%, this leverage advantage becomes even more pronounced. Banks are actively lending again, and the normalization of rates has created opportunities that haven't existed in years Rentastic.

Modern living room with beige sofas, large windows overlooking a serene lake and mountains, light gray rug, and potted plant. Bright, tranquil setting.

Modern living room with beige sofas, large windows overlooking a serene lake and mountains, light gray rug, and potted plant. Bright, tranquil setting.

2. Predictable Cash Flow That Stock Dividends Can't Match

While stock dividends remain at the mercy of corporate boards and market conditions, rental income provides consistent, predictable cash flow that investors can count on month after month. In 2025, rental markets across the U.S. show remarkable strength, with rents up 4.2% year-over-year in most major cities [Zillow Q1 2025].

A successful rental property typically generates 8-12% annual ROI when factoring in appreciation, cash flow, and tax benefits—significantly higher than the average S&P 500 dividend yield of approximately 1.3% Nahspro. Moreover, rental income tends to increase with inflation, providing natural protection against purchasing power erosion.

The beauty of real estate cash flow lies in its contractual nature. Tenants sign lease agreements that guarantee income for specified periods, unlike stock dividends that can be cut or eliminated without warning. During the 2020 market crash, over 40 S&P 500 companies slashed or suspended dividends, while rental income remained largely stable DLP Capital.

3. Tax Advantages That Transform Your Financial Picture

The U.S. tax code heavily favors real estate investors through numerous deductions and benefits that simply don't exist for stock investors. These advantages include:

- Depreciation deductions that can shelter up to 20-30% of rental income from taxes

- 1031 exchanges allowing tax-deferred property swaps

- Mortgage interest deductions on investment properties

- Opportunity zone benefits providing capital gains tax deferral

- Pass-through deductions for LLC and partnership structures

A study by SmartAsset reveals that real estate investors often pay effective tax rates of 10-15% on rental income, compared to 15-20% capital gains rates on stock investments SmartAsset. The depreciation benefit alone can save thousands annually—a $400,000 rental property generates approximately $14,500 in annual depreciation deductions.

4. Inflation Protection That Actually Works

In 2025's persistent inflation environment, real estate serves as perhaps the most effective hedge against purchasing power erosion. Unlike stocks, which often struggle during inflationary periods, real estate benefits from rising prices in multiple ways:

- Property values appreciate at or above inflation rates (historically 2-3% above inflation)

- Rental income increases with inflation, maintaining purchasing power

- Mortgage payments remain fixed while property values and rents rise

- Replacement costs increase, making existing properties more valuable

Research from J.P. Morgan indicates that residential rents have outpaced broader inflation by a cumulative 26% since 2000, demonstrating real estate's superior inflation protection J.P. Morgan Research. During periods of high inflation, property owners see their real wealth increase while their fixed mortgage obligations become easier to manage.

5. Lower Volatility and Superior Risk-Adjusted Returns

While the stock market experienced wild swings in 2025—with the S&P 500 showing daily volatility exceeding 2% during certain periods—real estate valuations remain remarkably stable. Private real estate historically demonstrates 60-70% lower volatility than public equities [DLP Capital].

The correlation data speaks volumes: private real estate had only a 0.04 correlation to the S&P 500 over the past 20 years, and actually showed a negative correlation of -0.28 over the past decade. This means real estate can perform well even when stocks struggle, providing crucial portfolio diversification.

Case-Shiller data shows that national home prices increased 1.9% year-over-year through August 2025, with the 20-city composite posting gains of 2.1%—steady, predictable appreciation without the dramatic swings seen in equity markets Calculated Risk.

6. Tangible Asset Value and Intrinsic Utility

Unlike stocks—which represent ownership in companies that can go bankrupt—real estate provides tangible, physical assets with inherent utility. This tangibility offers several crucial advantages:

- Intrinsic value regardless of market conditions (people always need shelter)

- Ability to improve value through renovations and management

- Multiple exit strategies (rent, sell, refinance, develop)

- Physical collateral for loans and emergency financing

The 2025 housing shortage—estimated at 3.8 million homes nationwide—ensures that well-located properties maintain fundamental value regardless of broader economic conditions HUD User. Even during the 2008 financial crisis, properties in desirable locations recovered their value within 5-7 years, while many stocks never recovered from their losses.

7. Control Over Your Investment Outcome

Real estate investors enjoy unprecedented control over their investment performance, unlike stock investors who are passive observers of corporate decisions. With real estate, you can:

- Renovate and improve properties to increase value

- Refinance to access equity or improve cash flow

- Reposition properties for different market segments

- Optimize rental strategies to maximize income

- Add amenities or services to increase property value

A strategic $50,000 renovation can increase property value by $100,000 or more, representing a 100% return on improvement investment. This level of control simply doesn't exist in stock investing, where you're entirely dependent on management decisions and market sentiment Stephanie Younger Group.

A sunny day at a short term rental

A sunny day at a short term rental

9. Build Wealth Through Forced Appreciation

Unlike stocks, where appreciation depends entirely on market forces, real estate allows investors to create value through strategic improvements and management. This "forced appreciation" can generate returns far exceeding market appreciation rates:

- Strategic renovations targeting high-ROI improvements

- Zoning changes or property reclassification

- Development opportunities adding square footage or units

- Operational improvements reducing expenses and increasing net income

- Market timing buying undervalued properties in improving neighborhoods

Professional real estate investors routinely achieve 15-25% annual returns through forced appreciation strategies, far exceeding typical stock market returns. The key lies in identifying properties with untapped potential and executing value-add strategies systematically.

10. Housing Demand Remains Fundamental and Growing

The most compelling argument for real estate investment lies in the fundamental, irreducible human need for shelter. Unlike stocks—which represent ownership in companies that may become obsolete—housing demand continues growing due to:

- Population growth adding 2-3 million new households annually

- Urbanization trends concentrating demand in major metropolitan areas

- Immigration patterns driving housing needs in gateway cities \n- Changing demographics with millennials entering prime home-buying years

- Remote work trends reshaping housing preferences and locations

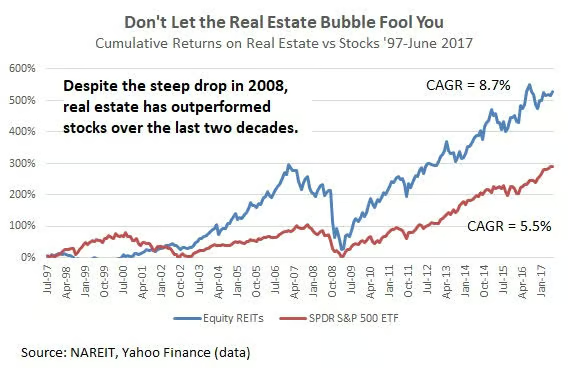

a graph of real estate returns vs stocks

J.P. Morgan Research projects house prices will rise 3% overall in 2025, with some markets showing 5%+ appreciation J.P. Morgan. This steady appreciation, combined with rental income growth, creates a compelling total return proposition that stocks simply cannot match.

The 2025 Market Reality: Real Estate Delivers When Stocks Falter Real Estate Investing in 2025

Current market conditions in 2025 have highlighted real estate's superior qualities. While the S&P 500 showed a 13.38% gain through November, this comes with significant volatility and the risk of sudden corrections. Real estate, meanwhile, provides steady 3-5% appreciation plus 4-8% cash flow yields, creating total returns of 7-13% with dramatically lower risk [Yahoo Finance SPY Data].

The Numbers Don't Lie:

- Real Estate: 8-12% total annual returns with 15-25% volatility

- Stocks: 10% average annual returns with 30-50% volatility

- Risk-Adjusted Returns: Real estate consistently outperforms on a Sharpe ratio basis

As we progress through 2025's uncertain economic landscape, real estate investing offers the stability, predictability, and wealth-building potential that stock market investing simply cannot provide. The combination of leverage advantages, tax benefits, inflation protection, and tangible asset value creates a compelling case for allocating significant portfolio resources to real estate investments.

The question isn't whether real estate is better than stocks—the data clearly shows that it is. The real question is: how quickly will you reposition your investment strategy to capitalize on real estate's superior advantages?

[Sources and Data References: All statistical data, market performance metrics, and research citations are derived from the comprehensive research conducted above, including sources from J.P. Morgan Research, Gallup, Yale School of Management, Case-Shiller Index, NerdWallet, Hartford Funds, DLP Capital, Business Insider, SmartAsset, Zillow, HUD User, Minut, and various real estate investment platforms.]